change in net working capital formula dcf

This has been a guide to Accounting Equation Formula. Purchasing Power Parity Formula.

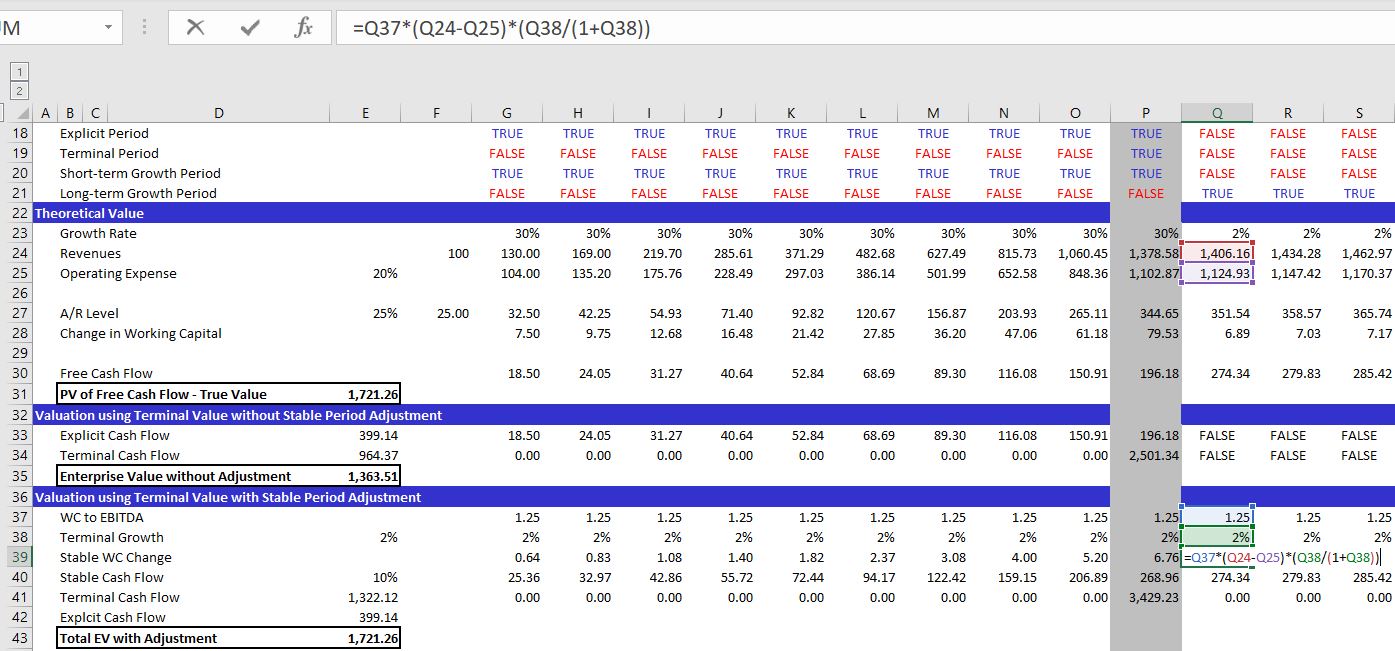

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Coupon Bond Formula Example 1.

. Free Cash Flow Formula. The formula for fixed cost can be calculated by using the following steps. Invested Capital Fixed Assets Net Working Capital NWC.

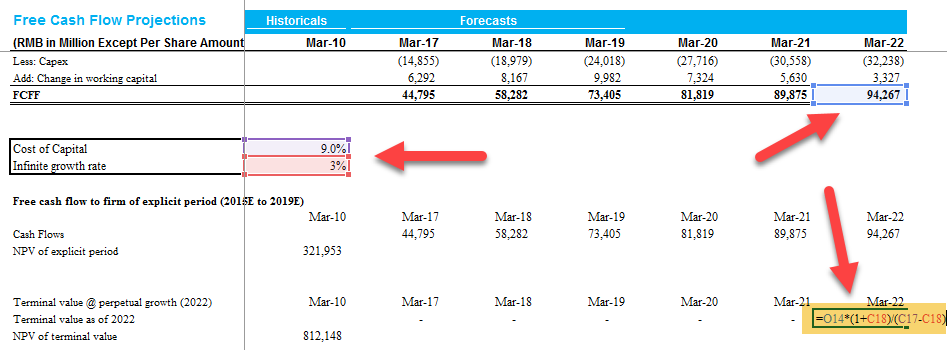

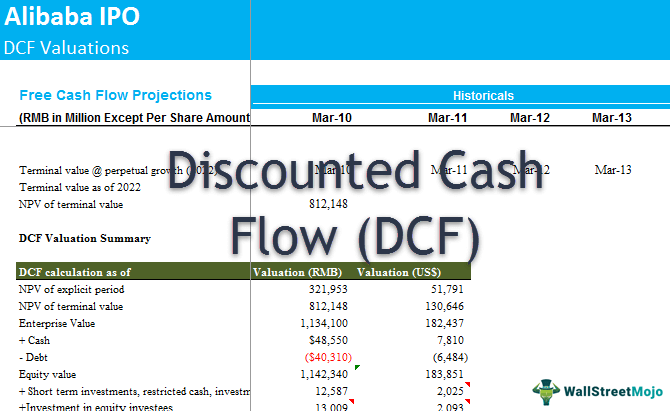

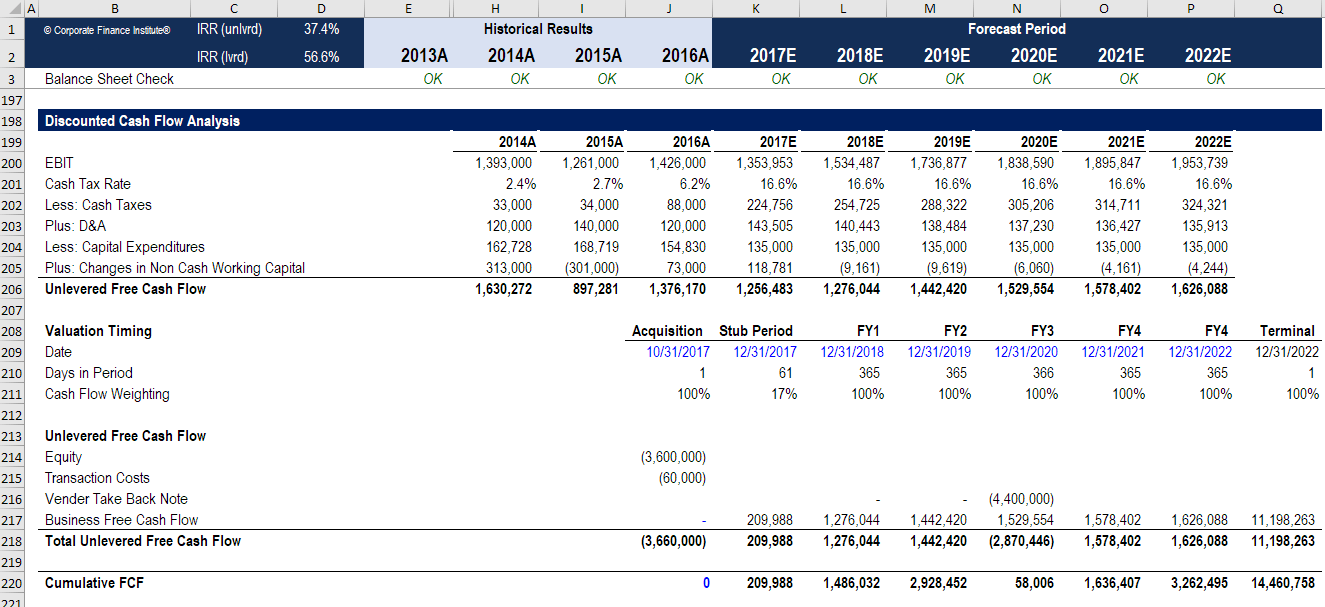

Central Limit Theorem Formula. Change in Net Working Capital Formula. Discounted cash flow DCF is a valuation method used to estimate the attractiveness of an investment opportunity.

You may also look at the following articles to learn more Examples of Retention Ratio Formula. Will also help in the management of funds. This is a guide to Interpolation Formula.

Central Limit Theorem Formula. Sustainable Growth Rate 1501 Explanation of the Sustainable Growth Rate Formula. Fixed Cost Explanation.

This is a guide to the Importance of Working Capital. The WACC discount formula is. Ending Inventory 50000 Therefore XYZ Ltd has an inventory of 50000 at the end of the year.

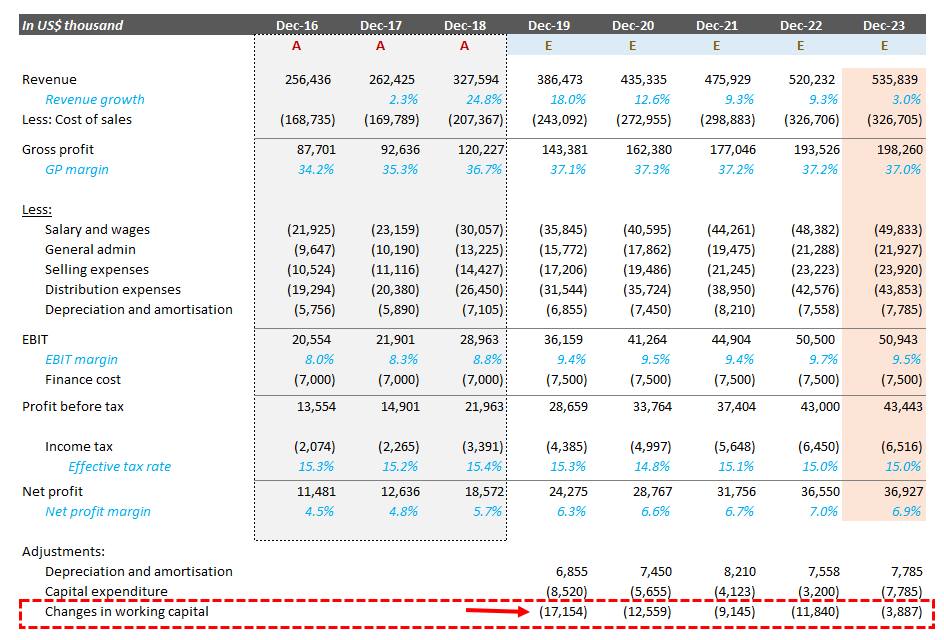

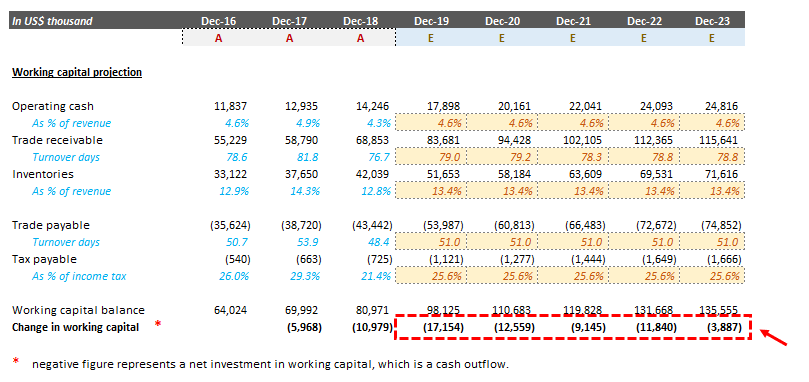

Examples of Absorption Costing Formula With Excel Template Absorption Costing Formula. Price Elasticity of Demand 4385 98. Calculate net working capital Calculate Net Working Capital The change in net working capital of a firm from one accounting period to the next is referred to as the change in net.

Here we discuss How to Calculate Accounting Equation along with practical examples. Let us take the example of some coupon paying bonds issued by DAC Ltd. Here we discuss the formula to calculate and top 11.

σ 2 64 1 16 36 16 36 4 81 8. Therefore the variance of the data set is 3175. A working capital formula is extensively used in a business to meet short-term financial obligations or short-term liabilities.

How do Equity Value and Enterprise Value change immediately after these events. And when you have a larger or smaller population on which basis one can carry out the survey. In management accounting absorption costing is a tool which is used to expense all costs which are linked with the manufacturing of any product.

It is very easy and simple. R - Squared Formula. Price Elasticity of Demand 045 Explanation of the Price Elasticity formula.

Positive net working capital is resultant when a company has enough current assets over its current dues. As a general rule the more current assets a company has on its balance sheet in relation to its current liabilities the lower its liquidity risk and the better off itll be. To use this formula the desired level of precision the population size should be known.

Lets dive deeper into these two formulas and how theyre different below. Calculator For Working Capital Turnover Ratio. The law of demand states that as the price of the commodity or the product increases the demand for that product or the commodity will eventually decrease all conditions being equal.

You may also look at the following articles to learn more Net Cash Flow Formula. σ 2 3175. Ending Inventory 3000 40000 20000.

For this the survey is done for a set of random sample. Purchasing Power Parity Formula. You need to provide the two inputs ie.

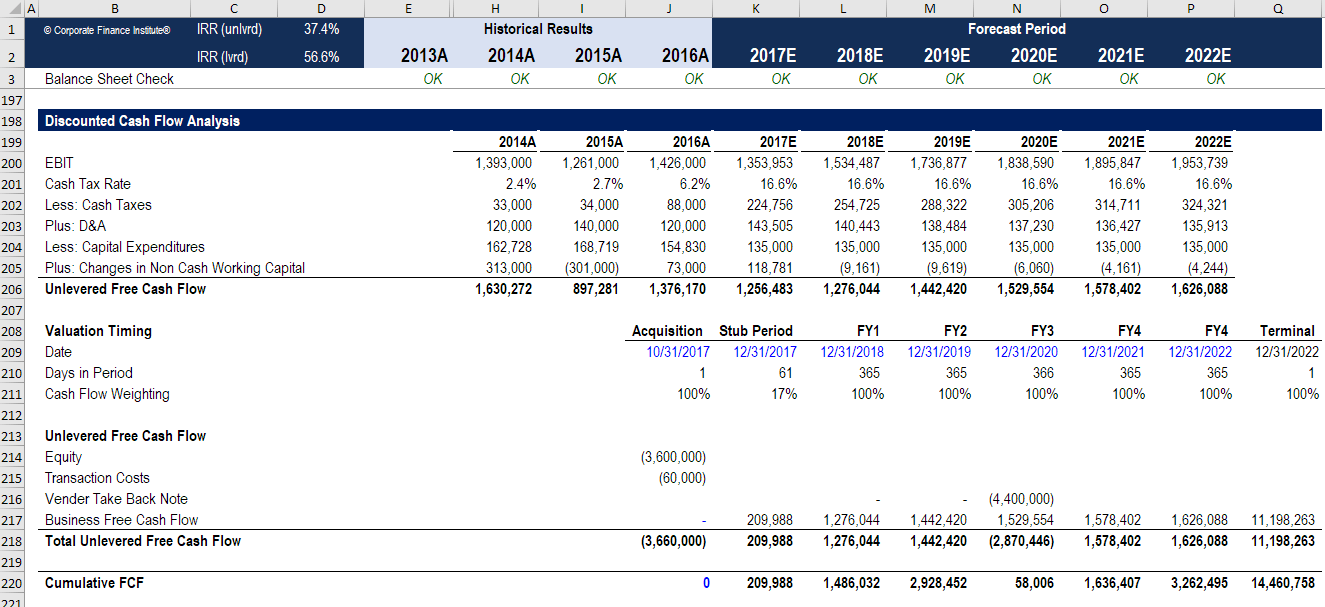

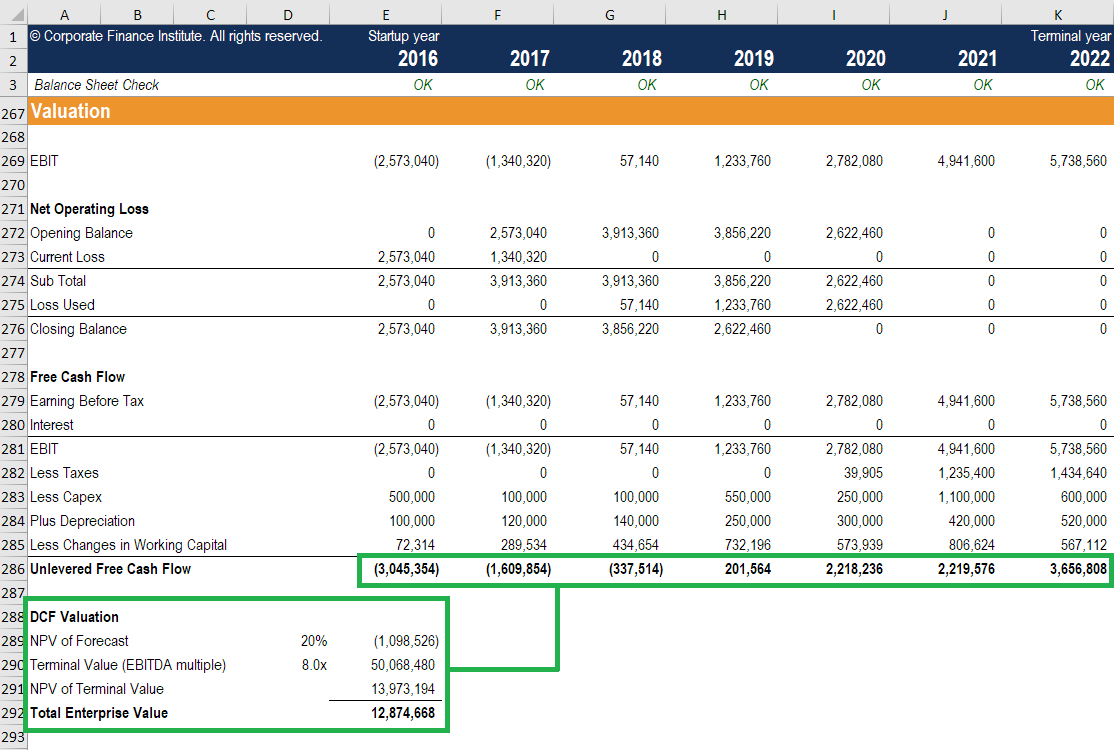

Similarly change in net working capital helps us to understand the cash flow position of the company. In Scenario A the change in invested capital was 25m more for an increase of 5m in NOPAT. DCF analyses use future free cash flow projections and discounts them using a.

So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. Change in Net Working Capital Formula. Firstly determine the variable cost of production per unit which can be the aggregate of various cost of production such as labor cost raw material cost commissions etc.

Net Working Capital Formula in Excel With Excel Template Here we will do the same example of the Net Working Capital formula in Excel. How to Calculate Degree of Financial Leverage. Official City of Calgary local government Twitter account.

One year back the company had raised 50000 by issuing 50000 bonds worth 1000 each. You can easily calculate the Net Working Capital using Formula in the template provided. WACC EV x Ce DV x Cd x 1-T and the APV discount formula is.

Net Operating Assets increases by 50 because the PPE is an Operating Asset and no Operating Liabilities change so Enterprise Value increases by 50. How to Calculate Net Working Capital NWC The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. In contrast in Scenario B the NOPAT increased 5m too but 150m was spent so focusing on the growth in NOPAT by itself would be misleading in the latter case.

We also provide a downloadable excel template. Return on Sales Formula. On the other hand if the company is unable to produce positive working.

Here we discuss how to calculate the Interpolation Formula along with practical examples. I an trying to do a DCF for a private firm and am looking for benchmark financial and DCF model for. Firstly create a population comprising a large number of.

Cochrans formula is the most appropriate formula for finding the sample size manually. Which of the following formula is correct to calculate the value of levered firm as per MM Model. R - Squared Formula.

As the name suggests these costs are variable in nature and changes with the increase or. Working Capital Current Assets Net of Depreciation Current Liabilities. Statement line item Total base figure.

As per Net Income approach if capitalization rate increases market value of firm A Decreases B Increases C Remains constant D Without data it is not possible to tell what will happen Answer. There are two primary discount rate formulas - the weighted average cost of capital WACC and adjusted present value APV. The formula for ending inventory can be simply calculated by using the following four steps.

APV NPV PV of the impact of financing. Total current assets and total current liabilities. The MPU9250 9-Axis Gyro Accelerator Magnetometer Module can provide acceleration angle change and magnetic field on 3 axes x y and z with high speed and accuracy InvenSense lowered power consumption and decreased the size by 44 compared to the MPU-9150 It will show up in the log file as IMU2 Aug 22 2017 SPI 0 splitter v1 0.

Change of duration of credit period given to trade receivable or duration of trade payables payments etc. So a positive change in net working capital is cash outflow. Every business wants to grow and achieve new heights.

Explanation of Working Capital Formula. Absorption Costing Formula Table of Contents. Sustainable Growth Rate 07276 2062.

A company raises 200 in Debt to pay for issuances of 100 in Common Dividends and 100 in Preferred Dividends. Free Cash Flow Formula. Keep up with City news services programs events and more.

The formula for a variance can be derived by using the following steps.

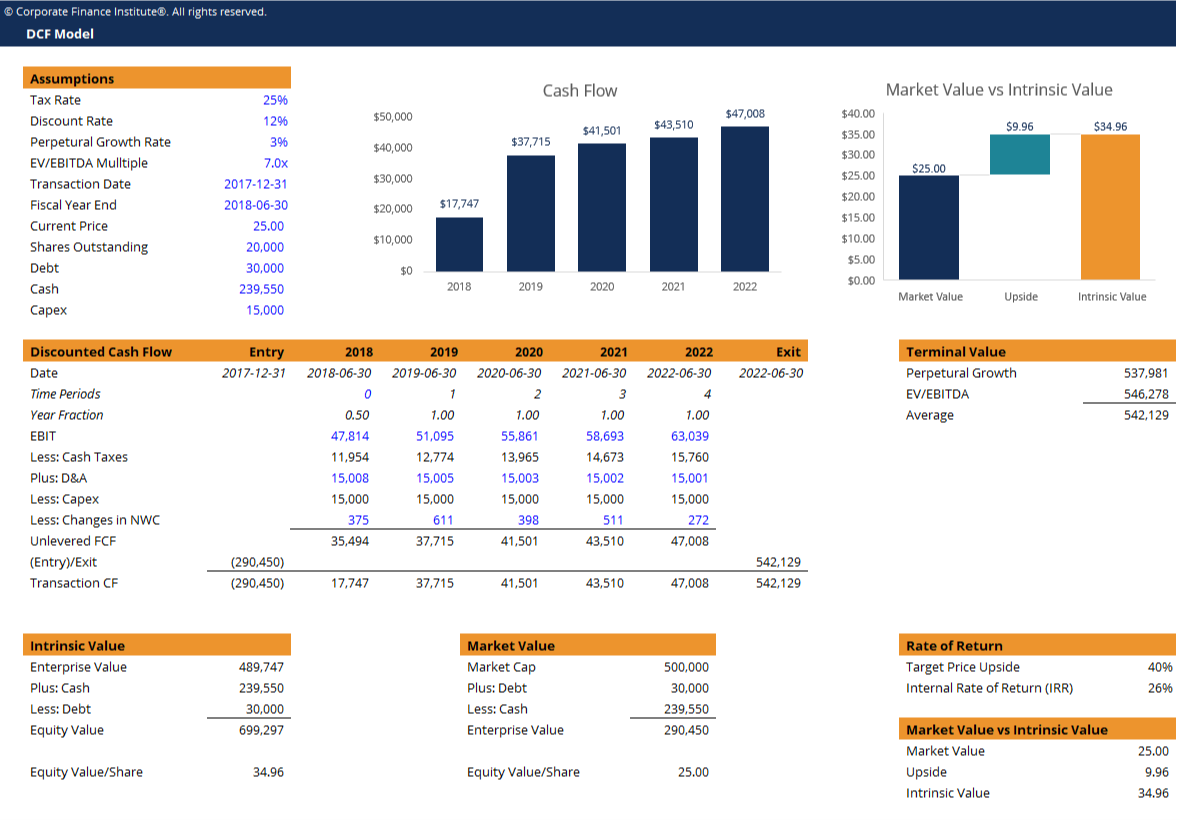

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Change In Net Working Capital Nwc Formula And Calculator

Dcf Model Tutorial With Free Excel Business Valuation Net

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Dcf Sutton Capital

Dcf Model Tutorial With Free Excel Business Valuation Net

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Dcf Formula Calculate Npv Cfi

Change In Net Working Capital Nwc Formula And Calculator

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy

Projecting Net Working Capital For Free Cash Flow Calculation Dcf Model Insights Youtube

Dcf Model Training The Ultimate Free Guide To Dcf Models

Normalised Cash Flow In Dcf Working Capital Taxes And Stable Roic Edward Bodmer Project And Corporate Finance

Change In Working Capital Video Tutorial W Excel Download

Dcf Analysis Pros Cons Most Important Tradeoffs In Dcf Models